Top Hard Money Lenders in Atlanta: Fast and Reliable Funding Solutions

Top Hard Money Lenders in Atlanta: Fast and Reliable Funding Solutions

Blog Article

Why Hard Cash Lenders Are the Secret to Fast Funding in Real Estate

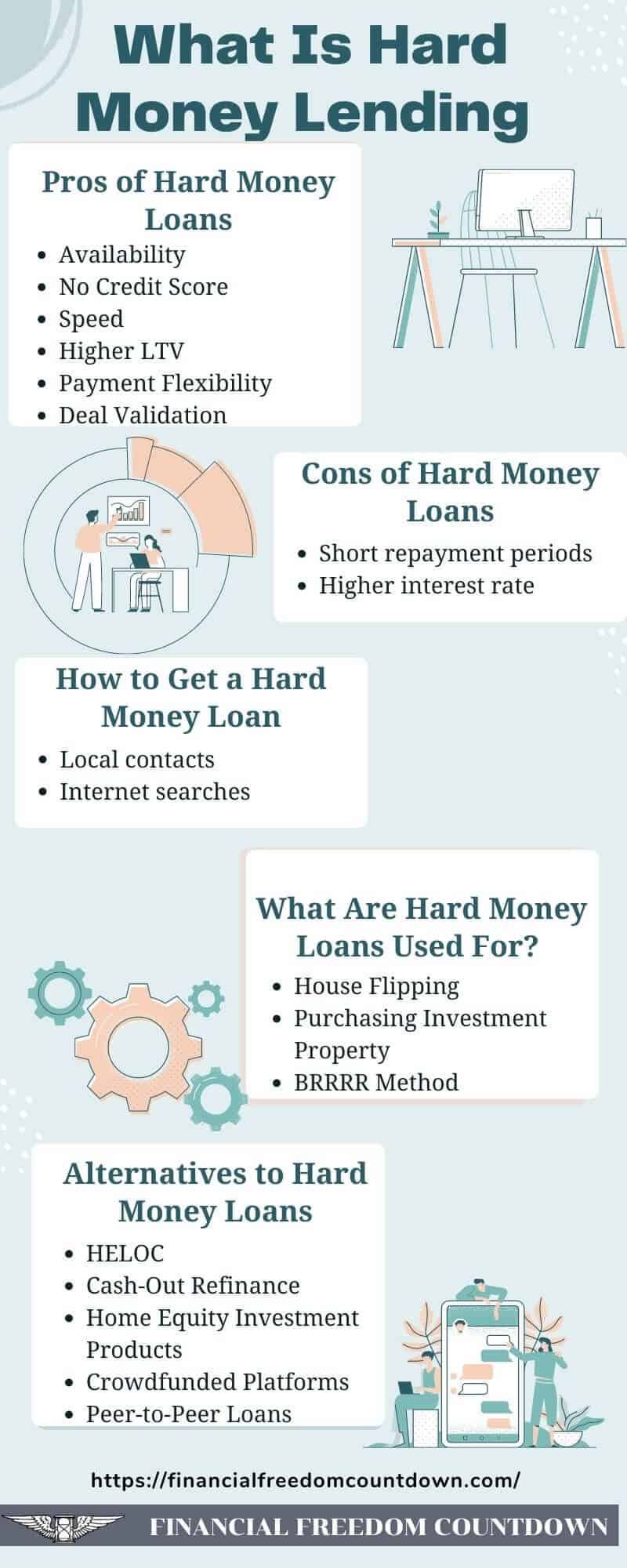

Tough money lenders play a pivotal role in this landscape by focusing on the worth of the building over the creditworthiness of the consumer, allowing deals to shut in a matter of days. Comprehending the subtleties of difficult money lending might brighten why investors progressively transform to these resources for fast funding mixture.

What Are Tough Cash Car Loans?

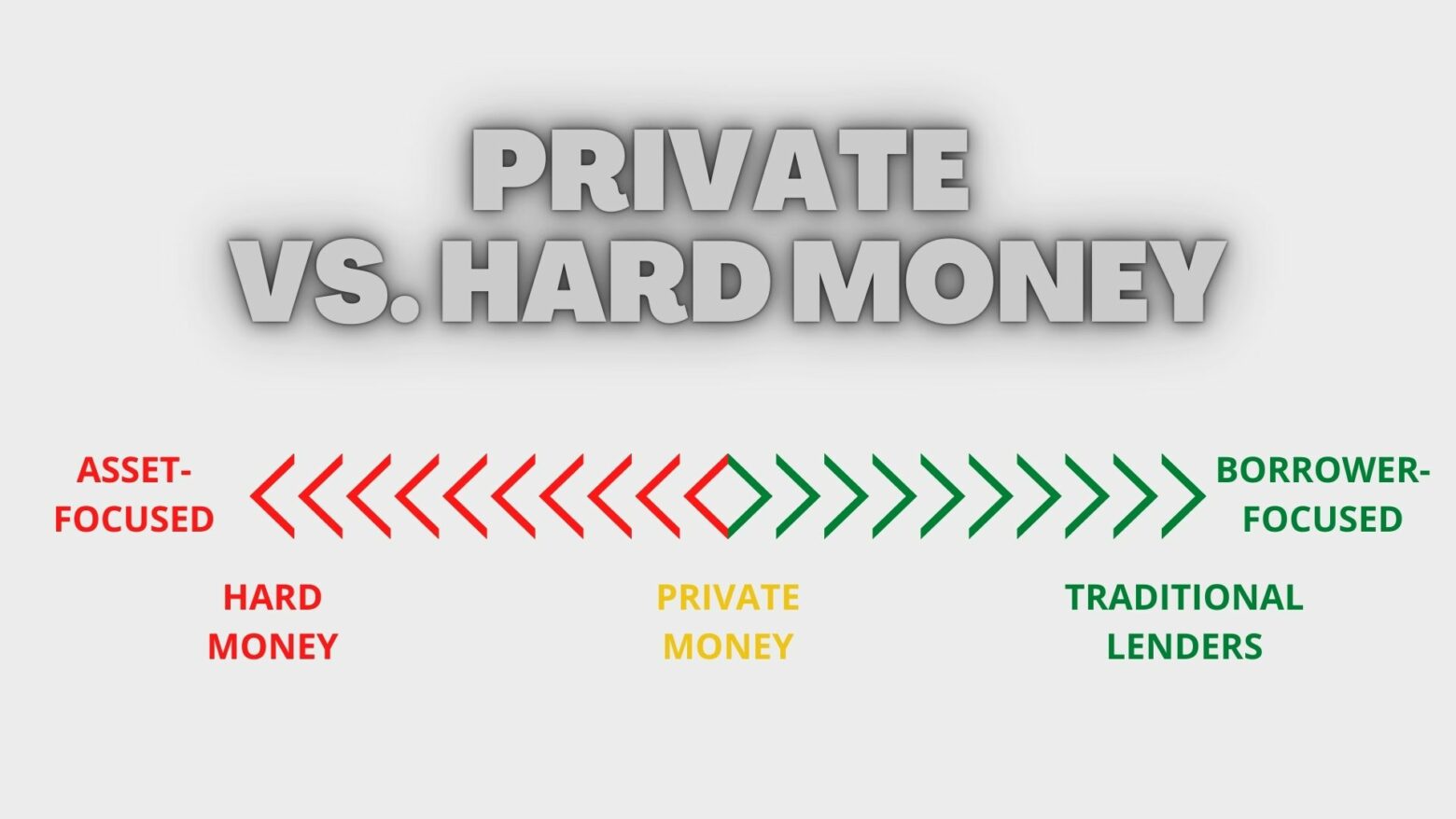

In the realm of property funding, hard money car loans act as a valuable choice to traditional home mortgage choices. These financings are largely backed by the value of the residential property itself instead of the creditworthiness of the customer. Commonly offered by personal investors or companies, difficult money finances offer a fast opportunity for obtaining capital, especially in circumstances where standard financing may be inaccessible or ineffective.

Tough money lendings are characterized by their temporary duration, usually varying from a few months to a couple of years. The lending amounts can vary considerably, depending upon the home's worth and the loan provider's requirements. Rates of interest for tough cash loans are typically more than conventional loans, showing the increased risk lending institutions take on because of the dependence on home collateral.

The application procedure for difficult money lendings is usually expedited, enabling consumers to secure funding swiftly, which is especially beneficial in competitive property markets. Customers should be mindful of the conditions and terms linked with these loans, as they vary significantly from standard home loan contracts. Comprehending the specifics of difficult cash fundings is essential for making notified choices in realty financial investment.

Benefits of Difficult Cash Financing

One considerable advantage of difficult money financing is the speed of access to funds, which can be vital in fast-paced real estate deals. Unlike typical financing alternatives that might involve extensive authorization procedures, hard cash lendings can commonly be safeguarded within days, allowing capitalists to take financially rewarding chances promptly.

One more benefit is the flexibility that tough cash lenders offer. These loan providers are normally more lenient with their requirements, focusing primarily on the value of the residential property rather than the debtor's credit rating. This permits borrowers with less-than-perfect credit scores to get financing, making it an attractive choice for many investors.

Furthermore, hard money financing can assist in the procurement of troubled homes needing immediate restoration. Capitalists can use the funds to purchase and refurbish residential properties rapidly, boosting their market worth and prospective returns.

Exactly How to Certify for Hard Money

Generally, lending institutions will require a down settlement, which can range from 20% to 30%, depending on the task's regarded risk. A comprehensive evaluation of the residential property's condition and bankability is essential, as loan providers wish to ensure their financial investment is safe. Borrowers should additionally be prepared to provide an in-depth business strategy that describes the intended use the funds and the projected timeline for the task.

Furthermore, having a solid record in property investing can improve a borrower's reliability, also if see it's not an official demand. Inevitably, understanding these standards and preparing the essential documentation can considerably improve the certification process for hard money fundings, promoting quicker accessibility to funds genuine estate endeavors.

The Application Refine Clarified

Understanding the needs for tough cash fundings prepares for navigating the application procedure effectively - hard money lenders atlanta. The application process for tough cash financings is typically streamlined contrasted to standard financing, allowing investors to protect funding promptly

First, applicants have to prepare a thorough car loan application that includes monetary and individual info, building information, and financial investment plans. Lenders typically focus on the property's worth over the debtor's creditworthiness, so a comprehensive home evaluation is critical.

Following, potential customers need to give documents such as bank statements, income tax return, and proof of properties. This details aids lending institutions evaluate the customer's financial security and the task's usefulness.

When the application is submitted, lenders will certainly carry out a due persistance process, which might include an examination of the home's condition and possible resale value. This analysis typically takes a couple of days, enabling for rapid decision-making.

Instance Studies: Success Stories

Genuine estate financiers frequently seek out tough cash financings to capitalize on time-sensitive possibilities, and numerous success tales show the efficiency of this funding approach. With only days to act before the auction, they secured a hard money financing, allowing them to acquire the residential or commercial Read Full Report property promptly.

By getting a hard cash lending, the investor closed the deal within a week. The residential property was then refurbished and refinanced into a conventional home mortgage, enabling them to recuperate their preliminary investment while preserving ownership and cash flow.

These instances underscore just how tough cash lenders supply the agility and economic support required to confiscate financially rewarding actual estate opportunities, inevitably changing obstacles right into lucrative ventures for financiers.

Conclusion

Interest prices for hard cash financings are usually greater than conventional financings, reflecting the boosted threat loan providers take on due to the dependence on home security.

The application process for difficult money financings is generally accelerated, making it possible for borrowers to secure financing promptly, which is specifically advantageous in affordable real estate markets. Unlike typical lendings, hard cash loan providers focus primarily on the value of the residential or commercial property instead than the borrower's credit history score or earnings degree.Real estate financiers typically look for out tough money car loans to exploit on time-sensitive possibilities, and countless success stories show the performance of this financing approach. With only days to act before the public auction, they safeguarded a hard cash loan, allowing them to buy the pop over here home swiftly.

Report this page